AbstractThis paper starts from the concept and manifestation of defective capital contribution, focuses on the restriction of the rights of shareholders with defective capital contribution, elaborates on the restriction of the rights of shareholders with defective capital contribution in the various aspects of corporate governance, as well as a series of legal consequences triggered by the defective capital contribution. Through the analysis of theory and practice, it aims to provide theoretical support and practical guidance for the improvement of corporate governance and the protection of the legitimate rights and interests of all parties.

In the establishment and operation of a company, the capital contribution of shareholders is the cornerstone of the company's capital formation, which is related to the survival and development of the company and the security of transactions. However, in reality, the phenomenon of defective capital contribution occurs from time to time, and shareholders may fail to make full and timely capital contribution in accordance with the articles of association or the provisions of the law for various reasons, or there are problems such as overvaluation and defective rights in the contribution of non-monetary property. This not only affects the company's capitalization principle, but also may disrupt the normal operation order of the company. The existence of defective shareholders not only impacts the internal governance structure of the company and the balance of interests among shareholders, but also poses a threat to the security of transactions and market order outside the company.

From the internal point of view, if the defective shareholders enjoy the same rights as the fully funded shareholders, it will lead to an imbalance of interests among shareholders, destroying the foundation of trust among shareholders, and thus affecting the fairness and efficiency of the company's decision-making. For example, in the company's profit distribution, defective capital shareholders and fully funded shareholders according to their respective contributions to the distribution of profits, obviously unfair to the fully funded shareholders, may lead to conflicts and disputes between shareholders, hindering the normal operation of the company.

From the company's external point of view, the company's capital is an important basis for the company's external debt obligations, defective capital contribution may lead to the company's capital is not real, reduce the company's solvency, increase the risk of the counterparty, and damage the security and stability of market transactions. When the company due to insufficient capital can not fulfill the debt, the legitimate rights and interests of creditors will be infringed upon, which will not only affect the smooth progress of individual transactions, but also may trigger a chain reaction, the entire market credit system and economic order has a negative impact.

Therefore, in-depth investigation of defective capital shareholders' rights and legal consequences, has significant theoretical and practical value.

First, the concept and manifestation of defective capital contribution

(A) the concept of defective capital contribution

Defective capital contribution refers to the establishment of the company or in the process of capital increase, the shareholders in violation of laws and regulations and the provisions of the articles of association, did not fully and adequately fulfill the obligations of capital contribution, or capital property rights and interests of the situation of the existence of defects. From the legal point of view, the shareholders' capital contribution is a legal obligation to the company, aiming to provide the necessary material basis for the establishment and operation of the company, and to protect the normal operation of the company and the legitimate rights and interests of creditors. When a shareholder fails to fulfill his capital contribution obligation in accordance with the provisions of the law and the agreement of the articles of association, it constitutes a defective capital contribution. For example, Article 49 of the Company Law of the People's Republic of China (hereinafter referred to as the “Company Law”) clearly stipulates that shareholders shall pay in full and on time the amount of capital contributions they have subscribed to as stipulated in the articles of association of the company. If the shareholders make contributions in money, they shall deposit the full amount of the monetary contributions into the account opened by the limited liability company in the bank; if they make contributions in non-monetary property, they shall carry out the procedures for the transfer of their property rights in accordance with the law. Shareholders do not pay the full amount of contributions, in addition to the company shall pay the full amount, but also to the company shall be liable for the losses caused by the compensation. This provision clearly defines the obligations and standards of shareholders' capital contribution, and provides a clear legal basis for judging defective capital contribution.

(ii) the common forms of defective capital contributions

1, false capital contribution. False capital contribution refers to the shareholders on the surface to fulfill the obligation to contribute, but in fact did not really contribute or the value of the contribution and the value of the declaration of serious inconsistency.Common forms of performance include false documents to false registered capital, such as providing false bank statements, asset evaluation reports, etc.; or to fund the non-existent property, such as fictitious physical assets, intellectual property rights, etc..For example, Shareholder A in the establishment of the company, by forging bank transfer certificate, falsely declared its capital contribution of 1 million yuan, but in fact did not actually contribute.This behavior not only seriously damage the interests of the company and other shareholders, but also constitute a potential threat to the company's creditors, because the company operates on the basis of false capital, and may not be able to assume responsibility once faced with debt disputes.

2. Insufficient capital contribution.Insufficient capital contribution refers to the shareholders actually paid less than the amount of capital contribution in the company's articles of association. This situation is more common in corporate practice, may be due to the shareholders' financial constraints, poor expectations of the company's prospects and other reasons.For example, Shareholder B has made a capital contribution of 500,000 RMB in the articles of association, but has only paid 300,000 RMB within the stipulated capital contribution period, and the remaining 200,000 RMB has not been paid on time. Insufficient capital will directly lead to the company's capital does not reach the expected size, affecting the company's capital operation and business expansion, but also may lead to conflicts and disputes between shareholders, destroying the company's internal harmony and stability.

3、Evasion of capital contribution. (A) the concept of defective capital contribution Defective capital contribution refers to the establishment of the company or in the process of capital increase, the shareholders in violation of laws and regulations and the provisions of the articles of association, did not fully and adequately fulfill the obligations of capital contribution, or capital property rights and interests of the situation of the existence of defects.From the legal point of view, the shareholders' capital contribution is a legal obligation to the company, aiming to provide the necessary material basis for the establishment and operation of the company, and to protect the normal operation of the company and the legitimate rights and interests of creditors.

When a shareholder fails to fulfill his capital contribution obligation in accordance with the provisions of the law and the agreement of the articles of association, it constitutes a defective capital contribution.For example, Article 49 of the Company Law of the People's Republic of China (hereinafter referred to as the “Company Law”) clearly stipulates that shareholders shall pay in full and on time the amount of capital contributions they have subscribed to as stipulated in the articles of association of the company.If the shareholders make contributions in money, they shall deposit the full amount of the monetary contributions into the account opened by the limited liability company in the bank; if they make contributions in non-monetary property, they shall carry out the procedures for the transfer of their property rights in accordance with the law.Shareholders do not pay the full amount of contributions, in addition to the company shall pay the full amount, but also to the company shall be liable for the losses caused by the compensation.This provision clearly defines the obligations and standards of shareholders' capital contribution, and provides a clear legal basis for judging defective capital contribution.

5、Late capital contribution. Shareholders failed to complete the delivery of capital contribution in accordance with the articles of association of the company's agreed capital contribution time nodes, so that the company's capital arrangements are blocked, delayed operation plan. For example, shareholder E in accordance with the provisions of the articles of association should be established in the company within three months after the capital of 6 million yuan, however, until half a year past, shareholder E's capital is still not in place, resulting in the company's new product research and development projects are forced to put on hold, missed market opportunities.

Second, the legal basis for the restriction of defective capital shareholders' rights

(A) the principle of reciprocity of rights and obligations

Shareholders to enjoy the company's operating income, participation in decision-making and other rights should be fully fulfill the capital obligations as a prerequisite, defective capital to break this balance, it is necessary to cut its rights accordingly, in line with the concept of fairness and justice.

(ii) Maintain the principle of capitalization

Company law emphasizes the company's capital is full of stability, defective capital threat to capital adequacy, limit the rights of shareholders defective capital is to protect the company has the necessary means of sustained operation, external solvency.

III. Limitation of rights in practice

The People's Court shall not support the shareholder's request for invalidating the corresponding reasonable restriction on the shareholder's rights such as the right to request for profit distribution, the right to preferential subscription of new shares and the right to request for distribution of residual property in accordance with the Articles of Association or the resolution of the shareholders' meeting.In practice, a company may, in accordance with the provisions of this Article, impose the following reasonable restrictions on a shareholder who violates the obligation of capital contribution through the articles of association or resolution of the shareholders' meeting.

(i) Restriction on Voting Rights

In the resolution of the shareholders' meeting, according to the degree of defective capital contribution to reduce their voting rights proportionally. For example, Shareholder A's contribution accounted for 40% of the capital contribution, but the actual capital contribution only accounted for 20% of the capital contribution, in the resolution of the shareholders' meeting involving the disposal of the company's major assets, its voting right was reduced to 20%, to prevent the shareholders of defective capital contribution from utilizing their voting rights to manipulate the company's decision-making to the detriment of the interests of the company as a whole.

In the case of Beijing Huixin Botong Science and Technology Center (Limited Partnership) and others vs. Beijing Zhengyang Yihua Science and Technology Center (Limited Partnership) and others, the validity of the company's resolution was confirmed in a dispute [(2021) Beijing 02 Civil Final No. 8887], the court of first instance held that, “According to Article 16 of the Provisions of the Supreme People's Court on the Application of Several Issues of the Company Law of the People's Republic of China (III)

For example, Shareholder B has made a capital contribution of 500,000 RMB in the articles of association, but has only paid 300,000 RMB within the stipulated capital contribution period, and the remaining 200,000 RMB has not been paid on time.Insufficient capital will directly lead to the company's capital does not reach the expected size, affecting the company's capital operation and business expansion, but also may lead to conflicts and disputes between shareholders, destroying the company's internal harmony and stability.

3、Evasion of capital contribution.

Evasion of capital contribution refers to the shareholders in the establishment of the company, will have paid the capital secretly withdrawn, but still retains the identity of the shareholders and the original share of capital behavior.Common ways of capital evasion, including the capital contribution to the company's account and then transferred out, through the fictitious debt relationship will be transferred out of the capital, the production of false financial and accounting statements to inflate the profits for distribution, the use of related transactions will be transferred out of the capital, and so on.Such as shareholder C in the company was established, through the associated enterprises to sign a false contract of sale and purchase, its capital contribution of 500,000 yuan in the name of goods transferred out, resulting in the reduction of the company's capital, serious damage to the interests of the company and other shareholders, but also reduces the solvency of the company, the rights and interests of creditors constitute an infringement.

4, the contribution of property rights are defective.

When the shareholders to non-monetary property capital, if the property has defective rights, will also constitute a defective capital.Such as the setting of mortgage, pledge and other security rights of property contributions, or to the existence of property disputes, such as property contributions.

(iv) Limitations on the right to know

The right to be informed is an important part of the shareholders' co-benefit rights, which is the shareholders' right to know the company's operation status, financial status and other important information.Article 57 of the Company Law stipulates that shareholders have the right to inspect and copy the articles of association, register of shareholders, minutes of shareholders' meetings, resolutions of meetings of the board of directors, resolutions of meetings of the board of supervisors and financial and accounting reports.Shareholders may request to inspect the accounting books and documents of the company. If a shareholder requests to inspect the accounting books and documents of the Company, he/she shall submit a written request to the Company, stating the purpose. If the company has reasonable grounds to believe that a shareholder's access to the accounting books and documents has an improper purpose and may harm the legitimate interests of the company, the company may refuse to provide access and shall reply to the shareholder in writing within fifteen days from the date of the shareholder's written request, stating the reasons.If the company refuses to provide access, the shareholders may file a lawsuit with the People's Court. The protection of the right to know is crucial for shareholders.By accessing the relevant documents and information of the company, shareholders can understand the operation and management of the company in a timely manner, including the company's business development, financial income and expenditure, and major decision-making, etc., so as to provide the basis for shareholders to exercise other rights.Before exercising the right to vote, shareholders need to know the relevant information of the company through the right to know in order to make wise decisions; when exercising the right to request profit distribution, they also need to know the company's profitability to ensure that their interests are reasonably protected.The right to know is also an important means for shareholders to supervise the management of the company, which helps to prevent the management from abusing its power and jeopardizing the interests of the company and shareholders.

(ii) Restriction on the Right to Distribute Profits

At the stage of profit distribution of the company, the defective capital contribution shareholders shall not be entitled to participate in profit distribution in accordance with the normal equity ratio until their capital contribution is made up.Only after the defects in its capital contribution has been corrected, can restore the corresponding distribution qualification, to ensure that the company's profits flow to the company's capital enrichment of the real contributors.

Such as the company's year-end profit dividends, found that shareholder B there is a lack of capital contribution, before its full contribution, the company refused to allocate profits in accordance with its nominal shareholding ratio, to be made up for the capital of shareholder B, to restore its normal distribution of rights and interests. (iii) Restrictions on subscription rights to new shares When the company issued new shares, in order to prioritize the protection of the rights and interests of the shareholders of good faith, defective capital shareholders should be postponed or deprived of the right to subscribe for new shares under certain conditions, so as to promote the importance of the obligation to fulfill the capital contribution, to avoid free-riding behavior.When the company decides to issue new shares to finance the expansion of production scale, due to the delayed contribution of shareholder C, the management of the company decides to place the subscription rights of shareholder C after the shareholders with good faith, and only consider giving the corresponding subscription opportunities to the shareholder C after he makes up for the capital contribution and passes the company's examination.[...]

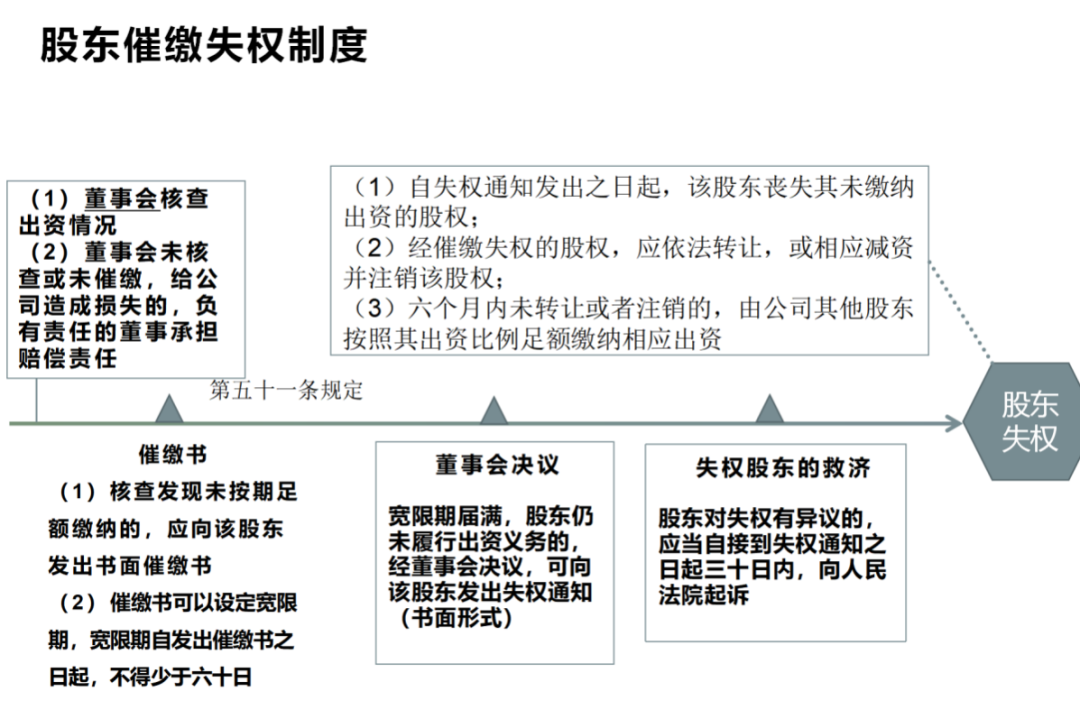

The above Articles 51 and 52 of the new Company Law together build a brand new system of shareholders' disqualification. Specifically, after the board of directors verifies the shareholders' capital contribution, if it finds that the shareholders have not paid the capital contributions stipulated in the articles of association in full and on time, it shall call for the capital contributions from such shareholders, and the call for the capital contributions shall be made in writing and issued by the company to be delivered to the called-up shareholders. Reminder of the need to set out the maximum period of grace for shareholders to contribute, the expiration of the grace period, the shareholders still do not fulfill the obligation to contribute, the company can issue a notice of loss of rights to the shareholders, the notice shall be in writing, since the date of issuance of the notice, the shareholders to lose the unpaid portion of the equity of the share capital. Legal Consequences of Defective Capital Contribution

Legal Consequences of Defective Capital Contribution

(I) the impact on the company

1. Operating difficulties. Due to the lack of funds, the company may not be able to expand business, update equipment, missed opportunities for development, and even into a business crisis. Such as a company due to insufficient capital contribution of shareholders Ding, new product development lag, market share was seized by competitors, the company's performance all the way down, once on the verge of bankruptcy.

2, reputation damage. The outside world knows that the company has a defective capital shareholders, will reduce the company's business reputation evaluation, affecting the construction of partnerships and business development. A company in the exposure of shareholders e false capital, suppliers have questioned its credit, requesting early payment or increase the price of supplies, the bank also tightened the loan policy, the company's financing difficulties increase steeply.

(ii) Impact on other shareholders

1. Dilution of interests. Defective capital shareholders with inaccurate capital still enjoy equity interests, indirectly dilute the share of other fully funded shareholders' interests, so that the latter input-output ratio imbalance. In a company, due to the shareholders of their voting rights are not reasonably restricted, some decision-making in favor of their personal interests, resulting in other fully funded shareholders of the distribution of profits, the company's control and other rights and interests have been weakened.

2. Decision-making imbalance. In the case of poorly restricted voting rights, defective shareholders may interfere with the normal decision-making shareholders meeting, resulting in the company's development strategy off track, damaging the long-term interests of other shareholders. For example, a company, shareholder geng delayed capital but still trying to dominate the company's decision-making, the implementation of some high-risk, short-sighted projects, and other shareholders expect a sound development strategy contrary to the internal conflicts, hindering the development of the company.

(iii) Impact on creditors

The solvency of the company is weakened by the inaccurate capital, and when the company is insolvent, the creditors' claims are at risk of being realized and their legitimate rights and interests are difficult to be fully protected. Such as a company due to poor management into debt crisis, when the creditors found that the shareholders Xin capital contribution is insufficient, the actual assets of the company is far lower than expected, resulting in a significant reduction in the proportion of creditor's claim recovery, suffered significant losses.

To summarize, the problem of defective shareholders throughout the whole process of corporate development, reasonable and precise limitations on their rights, as well as clarify the corresponding legal consequences, is to build a healthy corporate governance ecology, maintain the market economic order of the key links. Legislation should continue to refine the relevant rules, and judicial practice should strengthen the uniformity of adjudication standards, so as to prompt shareholders to make contributions in good faith, ensure that the legitimate rights and interests of all parties can be effectively safeguarded under the framework of the Company Law, and promote the steady progress of the company-based economy.

© Beijing JAVY Law Firm Beijing ICP Registration No. 18018264-1