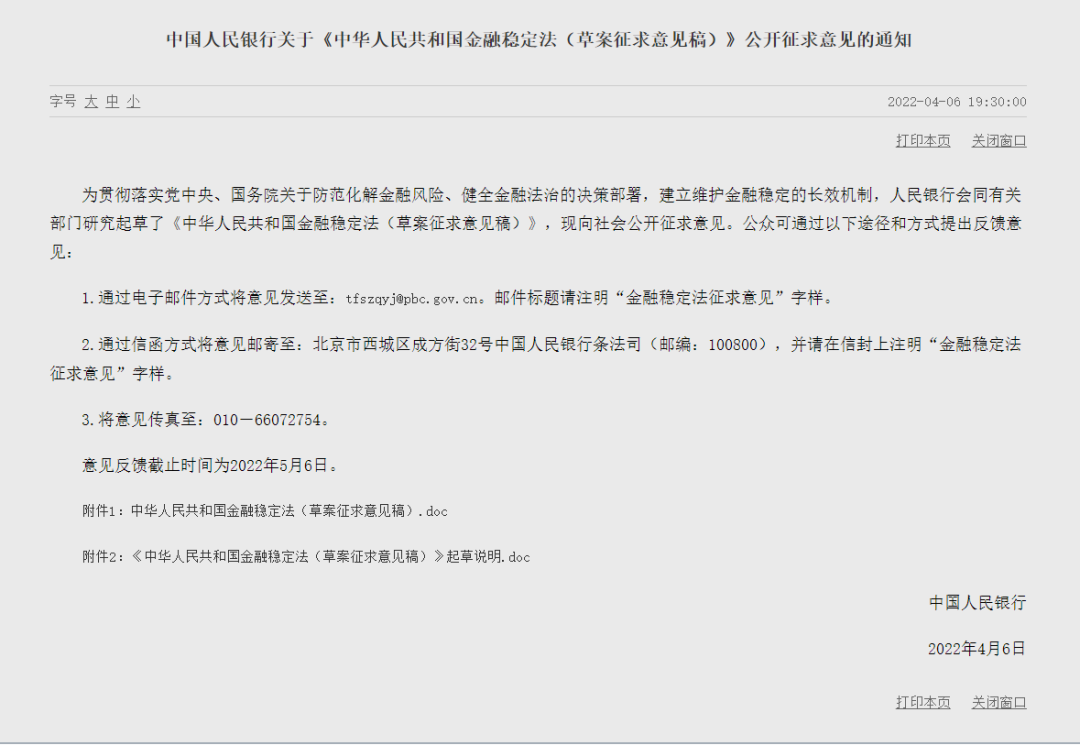

At 19:30 on April 6, 2022, the People's Bank of China publicly released the "Notice of the People's Bank of China on Public Comments on the Financial Stability Law of the People's Republic of China (Draft for Comment)". To implement the decisions and arrangements of the CPC Central Committee and the State Council on preventing and defusing financial risks and improving the financial rule of law, and establishing a long-term mechanism for maintaining financial stability, the People's Bank of China, together with relevant departments, studied and drafted the Financial Stability Law of the People's Republic of China (Draft for Comment).Now open to the public for comments” and provide a way to give feedback.

The Financial Stability Law of the People's Republic of China (Draft for Comment) (hereinafter referred to as the "Draft Financial Stability Law") has six chapters and forty-eight articles, which are: General Provisions, Financial Risk Prevention, Financial Risk Resolution, Financial Risk Disposal, Legal Responsibilities and By-laws provide provisions for safeguarding financial stability from multiple perspectives.

Chapter Number | Chapter Name | Clause number | Main content |

Chapter 1 | General | Articles 1 to 9 | Legislative purpose, financial stability goals, adherence to the leadership of the party, the principle of maintaining financial stability, responsibilities of the national financial stability and development overall coordination mechanism, local government responsibilities, security fund responsibilities, supervision, audit supervision, information dissemination management |

Chapter 2 | Financial Risk Prevention | Articles 10 to 18 | Licensed operation, main responsibility for risk prevention, access to shareholders and actual controllers, prohibited behaviors of shareholders and actual controllers, dividend distribution requirements, recovery and disposal plans, local government behavior requirements, regulatory synergy, information reporting and sharing |

Chapter 3 | Financial risk mitigation | Articles 19 to 22 | Main responsibility for risk resolution, local government risk resolution responsibility, early correction and supervision by regulatory authorities, early correction for depository preservation |

Chapter 4 | Financial Risk Disposal | Articles 23 to 38 | Section 1 Disposal Mechanism: Financial Risk Disposal, Division of Responsibilities, Major Financial Risk Disposal Mechanism, Efficient Execution, Cross-border Disposal Cooperation Section 2 Sources of Disposal Funds: Sources of Disposal Funds, Financial Stability Guarantee Fund Section 3 Resolution Measures and Instruments: Financial Management Department Resolution Measures, Overall Transfer, Write-down Requirements, Rights Protection, Depository and Industry Guarantee Fund Resolution Measures, Regulatory Exemptions Section 4 Judicial Connection: Centralized Jurisdiction and Release of Preservation Measures, Three Suspensions, and Judicial Review |

Chapter 5 | Legal Liability | Articles 39 to 45 | Accountability of the National Financial Stability and Development Coordination Mechanism, Government Departments and Personnel Responsibilities, Financial Institution Shareholders and Actual Controller Responsibilities, Financial Institution Responsibilities, Practice Prohibition, Information Dissemination Violation Responsibilities, Due Diligence Exemption |

Chapter 6 | By-laws | Articles 46 to 48 | Concept definition, scope of application, implementation time |

“The Draft Financial Stability Law”clarifies that the legislative purpose is to "improve the financial risk prevention, resolution and resolution mechanism, consolidate the responsibilities of all parties, improve resolution measures, implement resolution resources, and maintain financial stability", and the goal of financial stability is "to protect financial institutions, the financial market and financial infrastructure, to continue to play key functions, and continuously improve the ability of the financial system to resist risks and serve the real economy, to prevent individual local risks from evolving into systemic and overall risks, and maintain the bottom line of no systemic financial risks."

The website also published the drafting instructions for the Draft Financial Stability Law, which specifically explained the necessity of formulating the Financial Stability Law, the general idea and main content of the Financial Stability Law (see the figure below for details).

The need for a Financial Stability Act | (1) The urgent need to improve our country's financial rule of law system. (2) To provide a solid institutional guarantee for preventing and resolving major financial risks. (3) To summarize the experience of tackling major risks in a timely manner, and improve the ability to prevent and control systemic financial risks. |

The general idea and main content of the Financial Stability Act | (1) Improve the financial stability working mechanism. (2) Consolidate the responsibilities of all parties for financial risk prevention, resolution and disposal. (3) Establish a disposal fund pool, clarifying the matching of rights, responsibilities and interests, and a fair and orderly disposal fund arrangement. (4) Establish a financial stability guarantee fund. (5) Establish a market-based and legal-based risk disposal mechanism. (6) Strengthen accountability for violations of laws and regulations. |

Lawyer's Interpretation

It is not difficult to see from the promulgation and content of the Draft Financial Stability Law that our country attaches great importance to the construction of the financial rule of law. A multi-level financial legal system including the Insurance Law and other relevant administrative regulations, departmental rules and normative documents has laid the foundation for the construction of the financial rule of law in our country.

However, the previous regulations are all scattered and independent department regulations, lacking the overall design and overall arrangement of the financial industry, and there are obstacles to the connection between them. The drafting of the "Financial Stability Law" aims to prevent systemic financial risks and coordinate the stability of the entire financial environment from a macro and overall perspective: to establish a national financial stability and development overall coordination mechanism and office to coordinate the cooperation between various departments, complement each other; to establish financial risk prevention measures and risk disposal mechanisms to prevent and solve financial risks from the two stages before and after the occurrence of risks; to determine how to conduct judicial connections to ensure that cases can be more efficient and professional when they occur disputes are dealt with in a timely manner; the responsibilities and legal responsibilities of all relevant departments and personnel are implemented to achieve a clear division of labor and clear rights and responsibilities…

The "Financial Stability Law" will ensure the stability of the country's financial industry from multiple stages and perspectives, so as to better safeguard the country's economic security.

© Beijing JAVY Law Firm Beijing ICP Registration No. 18018264-1