Recently, a controversy surrounding vehicle insurance cancellations has sparked heated discussions online, revealing deceptive practices where consumers pay for "car insurance" only to discover hidden clauses and potential scams. In response, JAVY Law Firm's Attorney Gao Feng provided expert analysis in an interview with "Daily Economic News."

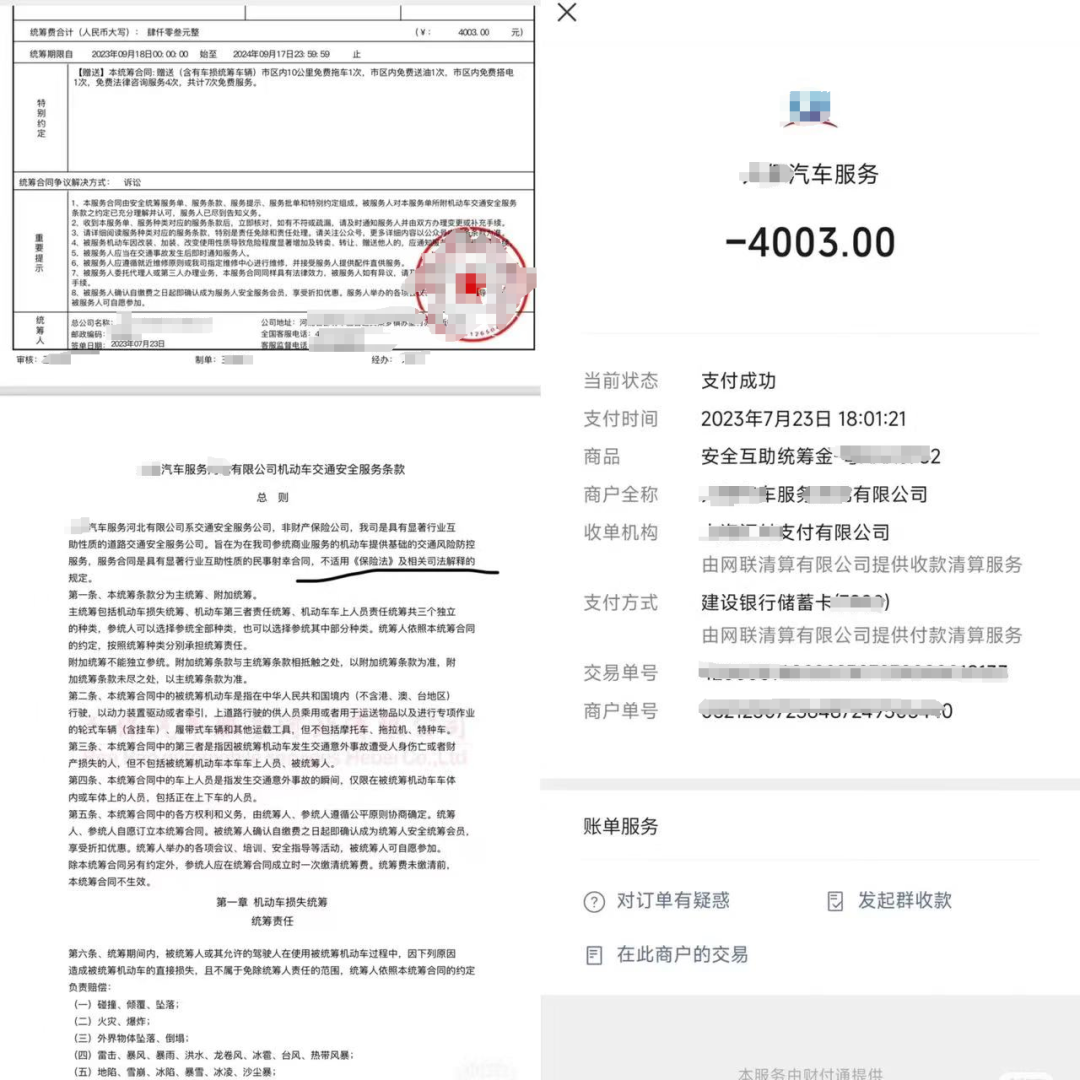

One vehicle owner, Mr. Zhang, shared his firsthand experience of purchasing what seemed like discounted insurance for about 4000 RMB, only to find unexpected clauses like the exclusion from provisions under the Insurance Law and related judicial interpretations.

The concept of "vehicle safety pooling" may appear to offer insurance coverage but operates differently, raising questions about its legal standing and consumer protection. Attorney Gao Feng highlighted that current Chinese laws and regulations do not explicitly prohibit such arrangements, affording legal protection to contracts between vehicle safety pooling companies and vehicle owners.

He cautioned that these arrangements, often mistaken for commercial insurance, lack the stringent regulatory oversight applied to traditional insurers. This oversight gap increases the risk of mismanagement or misappropriation of pooled funds, potentially leaving consumers inadequately compensated in case of disputes.

In legal proceedings related to traffic accident liability disputes, integrating safety pooling contracts for joint adjudication isn't straightforward under current legal frameworks. This complexity often leads to varying judgments even in similar cases, potentially affecting the compensation entitlements of aggrieved parties.

Attorney Gao Feng emphasized the need for clearer legal guidelines and regulatory oversight to protect consumers and ensure fair compensation practices in the event of disputes involving vehicle safety pooling arrangements.

© Beijing JAVY Law Firm Beijing ICP Registration No. 18018264-1