Case//

Recently, the epidemic has spread in many parts of our country, and some areas have adopted strict closure and control measures. The work and life of some residents have been affected to a certain extent, which has also disrupted the loan repayment plan of some home buyers, and the pressure of repayment on time is great. In one case, a citizen who lives in Kunshan, Jiangsu said that he was working in Shanghai. Due to the epidemic, “I am currently unable to work and have no income. I have to repay a mortgage of about 5,000 yuan on the 1st of every month”. On the one hand, he hopes to postpone the repayment, but he is worried that it will affect the credit investigation. What should he do?

//Lawyer's Interpretation

Since March of this year, local epidemics have occurred in many parts of our country, and whenever there are confirmed cases in the community, they will be closed and controlled, resulting in some people being unable to work or go to work, and repayment of mortgages has become a pressure. From the perspective of homebuyers, once they choose to cut off the mortgage, they will face a lawsuit from the bank, demanding the repayment of the arrears. If you are unable to repay, the house will be realised by foreclosure. Foreclosure houses are generally lower than the market price. If the foreclosure proceeds cannot offset the arrears, the remaining losses still need to be paid off. In addition, those who cut off their donations are likely to be classified as untrustworthy. In the age of credit and information, once you are listed on the credit blacklist, you will be "hard to do" in society in the future.

In order to solve this problem, the national level has released the policy goodwill to the greatest extent, and introduced relevant measures that are both emergency and inclusive.

On February 1, 2020, the central bank and other five departments jointly issued the latest policy regulations on housing loans during the epidemic prevention and control period, "Notice on Further Strengthening Financial Support for Novel Coronavirus Pneumonia", which clarifies that quarantine personnel, prevention and control personnel, and observers can delay repayment of loans, which will be favored in the credit policy.

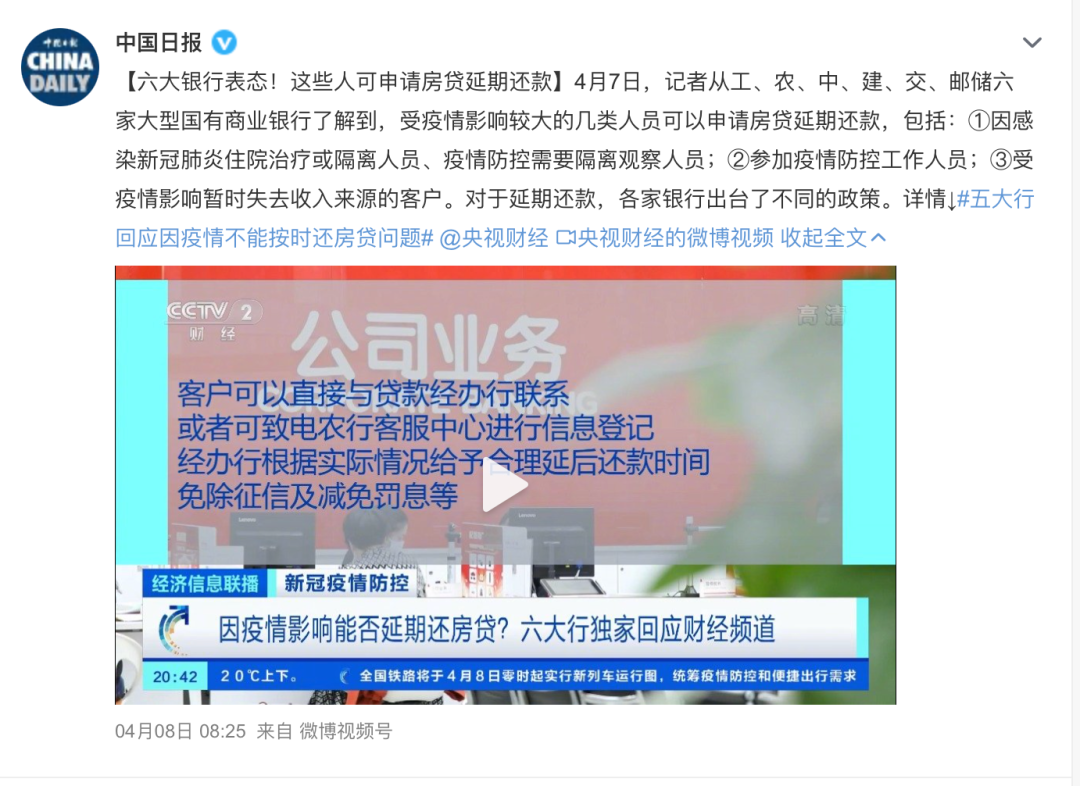

Recently, six large state-owned commercial banks including Industry, Agriculture, China, China Construction, Communications, and Postal Savings have stated that, affected by the epidemic, customers who meet the requirements can apply for a deferral of mortgage repayments. Several categories of people who are greatly affected by the epidemic can apply for deferred mortgage repayment, including those who are hospitalized or quarantined due to infection with new pneumonia, those who need to be quarantined and observed for epidemic prevention and control; those who participate in epidemic prevention and control; those who temporarily lose their source of income due to the epidemic client.

Regarding whether overdue loans will affect credit records, major banks have also issued corresponding policies in response to the epidemic. For example, ICBC stated that during the deferred repayment period, customers will not be included in the list of defaulting customers, and at the same time, it will protect customers with credit investigation and continue to strengthen customer services; Credit protection measures and opening a green channel for the acceptance of credit objections are to fully protect the rights and interests of customers. The Postal Savings Bank of China stated that it will strictly implement the credit rights protection policy, and make it clear that eligible mortgage customers who are inconvenient to repay due to the impact of the epidemic can assist in the adjustment of overdue credit records related to the epidemic.

According to the statement of the above-mentioned bank, it can be seen that in accordance with the relevant policies and regulations during the epidemic prevention and control period, the repayment can theoretically be postponed, but the specific policy of the bank should prevail. For Kunshan home buyers who are unable to work due to the impact of the Shanghai epidemic in this case, it is recommended to apply to the corresponding bank with the applicant's identity certificate, application for deferred repayment, type of deferred repayment and other materials required for the application. And the applicants should communicate well with the bank on credit reporting issues to protect their legitimate rights and interests.

© Beijing JAVY Law Firm Beijing ICP Registration No. 18018264-1